Kennesaw, July 1, 2016 ― VJI Tax Manager Chris Wiggins ventured into the Great Smoky Mountains last month to attend the 2016 annual conference of the Southeastern Association of Tax Administrators (SEATA) on June 26-29 at the Omni Grove Park Inn Resort in Asheville, North Carolina. SEATA is a professional organization of tax administrators that promotes fair, equitable, and efficient tax administration. The organization’s member states are Alabama, Arkansas, Florida, Georgia, Kentucky, Louisiana, Mississippi, North Carolina, South Carolina, Tennessee, Virginia, and West Virginia.

“I look forward every year to the SEATA conference because we’re given up-to-date information about law changes that directly affect our clients,” stated Wiggins. He said that most of the state legislatures amend or pass new laws at the beginning of each year and that they usually take effect on July 1. “The speakers at SEATA are well-informed insiders who know how the laws will impact our industry,” Wiggins noted.

Though he attended many offerings at the conference, Wiggins was keenly interested in hearing the details of new sales and use tax legislation passed in Georgia. “Naturally, we have many Georgia clients who will want to know, for example, that Georgia will require that all sales and use tax claims be filed electronically. In addition, the interest on refund claims has been significantly reduced. Furthermore, taxpayers with current direct pay permits will be required to meet new standards, which means they will have to reapply when their permits expire,” Wiggins explained.

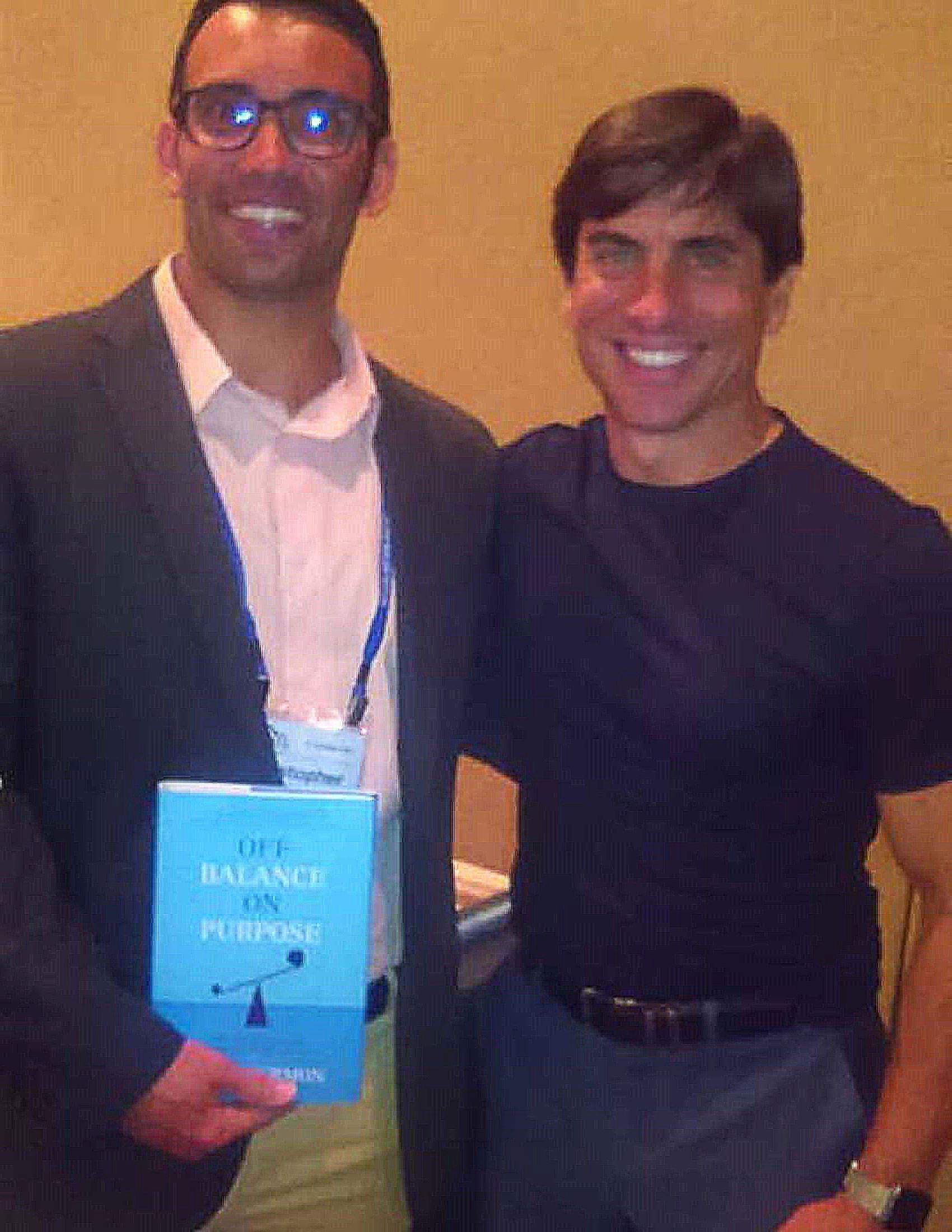

Wiggins also enjoyed the address by the keynote speaker, Dan Thurmon, who is an acrobat-turned-motivational speaker. “Dan talked about how juggling while riding a unicycle is just like trying to balance one’s work and personal life. It was an amazing way to explain how to achieve personal and professional success.” Wiggins also played in the event’s popular golf tournament in which his team came in second place. “One more thing,” said Wiggins. “Our venue in Asheville was the most beautiful place that I have ever had the privilege to visit. I’m encouraging everyone I know to go see and experience the charming splendor offered at the Grove Park Inn.”